Global investor expectations and mandates around environmental, social, and governance (ESG) impact reporting are increasing. Consequently, many companies are working to incorporate ESG metrics into financial reports and create meaningful impact reports highlighting performance around a range of ESG priorities. The data shows that businesses that track and disclose ESG metrics consistently outperform those that don’t. To support this, international financial regulatory organizations are creating standardized metrics that make ESG measurement and reporting more reliable, clear, and comparable.

Meanwhile, in the U.S., ESG has become politicized and maligned by some who conflate it with so-called “woke capitalism.” This pushback makes linking ESG performance directly to financial performance even more important for impact businesses, as data-backed reporting highlights the sound business case for mitigating ESG-related risk. Robust impact stories based on a foundation of solid data also improve brand reputation and employee engagement.

Sensiba is a Certified B Corporation that offers comprehensive accounting, tax, and consulting services to help businesses and individuals solve problems, navigate complexity, and build a foundation for sustainable growth. A top-75 U.S. firm, Sensiba is passionate about collaborating with clients to increase efficiency, mitigate risk, and prepare to embrace emerging opportunities.

In this Q&A, Sensiba Sustainability Practice Leader Julien Gervreau speaks with Bark about incorporating ESG metrics into financial reports, and why doing so is increasingly critical for every type of business.

Bark Media: How does integrating impact metrics into financial reporting help organizations increase profitability, revenue, investment, or operational efficiency?

Julien Gervreau: ESG risk, or sustainable impact risk, is financial risk, plain and simple. If you don’t measure and manage those risks effectively, they will create financial challenges for your business.

An EY study published in late 2024 shows that private equity funds that effectively measure and manage ESG-related risks have internal rates of return of up to 8% higher than their competitors. A 2023 analysis from McKinsey evaluated more than 2,200 companies and concluded that “financially successful companies that integrate environmental, social, and corporate governance (ESG) priorities into their growth strategies outperform their peers — provided they also outperform on the fundamentals.”

The McKinsey research highlighted companies dubbed “triple outperformers” based on total shareholder returns (TSR), financial performance, and ESG ratings. The analysis shows how growth and profitability are positively impacted by up to 7 percentage points above the study’s baseline when a company also demonstrates leadership on ESG issues. These examples are highlighted in a related blog post I published.

Private companies typically don’t share financial statements publicly. Can impact reporting enhance transparency and trust by providing public-facing performance data without divulging sensitive financial information?

In today’s world, impact/ESG reporting may represent even more important information than financial reporting. The International Financial Reporting Standards (IFRS) Foundation, which governs financial reporting in more than 140 countries, formed the International Sustainability Standards Board (ISSB) to develop a global baseline of sustainability disclosure. The IFRS/ISSB recognizes that intangible assets (i.e., skilled workers, client relationships, patents, brand value, etc.) represent 90% of a company’s market value. That means impact metrics and reporting can be used to relate the vast majority of a company’s value and serve as an incredibly effective way to increase transparency around performance and priorities.

Many companies are also integrating ESG metrics into financial reports. Can you share an example of what it looks like to do that and what that integration can help companies learn?

Our own company is a perfect example. We got certified as a B Corp in 2018, and over the years, a number of employees have pointed to that as a reason they want to work for us. The ideas stimulated by the B Impact Assessment, which helps B Corporations measure and improve their impact, led us to recognize the value of integrating diverse voices and various sustainability impacts. Now, we’re seeing and reaping the benefits of that.

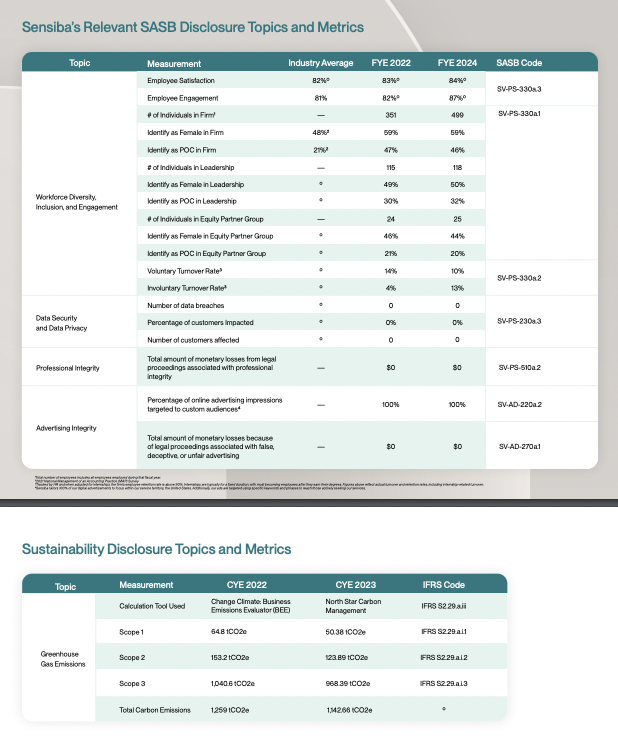

Our 2023-2024 Sustainability & ESG Impact Report proves the clear connections between our social impact metrics and greater employee engagement. If you look at some of the things we over-index for in our industry, we have 50% women in positions of leadership, 44% women in the equity partner group, and 32% people of color in leadership. If you look at our employee base, 60% of our firm are women, and 40% identify as people of color. Our employees see people like themselves in positions of leadership, and it’s inspiring.

When you take that a step further and look at employee turnover rates, ours are much lower than the standard in the accounting industry. As many HR studies have shown, there is a direct and clear link between turnover and the cost to find, recruit, and replace good people, representing a huge opportunity cost.

A lot of people have been talking about Costco recently, as the company publicly defended its DEI work in the face of backlash around its value. What’s your take on that?

Costco is a great example of how tying social impact metrics to financial metrics makes you more resilient to shifting political and cultural attitudes. After discussions with its board, Costco said diversity, equity, and inclusion are integral to business growth and operational success. The company effectively integrated its DEI efforts into its growth strategy, linking DEI to ways it’s engaging consumers in-store around what the company calls a “treasure hunt” retail strategy, which keeps people in the store longer. Costco demonstrated how to leverage impact metrics and tied them directly to its DEI efforts, presenting a compelling argument in favor of DEI integration during a time of increased challenges to the value of these programs.

Metrics are critical, but it can be hard for those of us who aren’t finance people to connect with data. Have you seen storytelling around impact reporting help engage employees, clients, and customers and make impact data more compelling and actionable?

In general, people connect with stories more than they connect with data, so if you can use storytelling to draw that line between how the collection and integration of sustainability data within your organization is driving positive results, that’s the secret sauce. If purpose-driven companies aren’t able to tell this story, nobody’s going to be able to do it, so this is a critical opportunity for all of us working in this space right now.

It can be hard, though, because typically storytellers aren’t data people and data people aren’t storytellers. So the question is: How do you bring the storytellers and the data people together to use the numbers as the foundation to build that rich human story? There’s a huge opportunity for collaboration there that can help us all collectively address the “Why?” question.

Getting back to the numbers, what role do investors and stakeholders play in pushing for integration of financial and impact metrics?

Smart investors recognize that sustainability/ESG risk equals financial risk. ESG is not political; it’s financial. It’s looking at the environmental, social, and governance factors that are going to create financial risk for an investment or organization. Investors are effectively acting in their own best interest by wanting more information relative to these various sustainability-related risk factors.

Globally, financial reporting organizations are supporting this need by developing trustworthy, comparable standards. In 2022, the IFRS/ISSB assumed responsibility for the SASB (Sustainability Accounting Standards Board) Standards, with a commitment to “maintain, enhance and evolve the SASB Standards and [encourage] preparers and investors to continue to use the SASB Standards.” The SASB Standards provide an industry-specific framework for measuring ESG factors, with a focus on identifying, measuring, and managing material risks that result from various ESG/sustainability impact factors for companies across the economy. SASB is critical for companies, organizations, and investors seeking to understand where their sustainability- and climate-related risks and opportunities lie.

What are best practices for embedding impact data directly into accounting processes? What specific tools or frameworks do you recommend?

Build a SASB metrics table into your impact report to provide clarity on your most material sustainability impacts. SASB has defined material sustainability risks and opportunities, as well as specific metrics associated with a number of topics, for 77 industry sectors. Every company is covered by one or more of the SASB standards. As a private company, you want to make sure your SASB-aligned metrics are easily accessible to investors, lenders, and other financial stakeholders — they expect to see them.

Start with a double materiality assessment to understand your company’s unique sustainability-related risks and opportunities and which data streams to track. Create input fields in existing reporting systems to hold the impact data so reports can easily be pulled for your ESG metrics. Keeping nonfinancial data in the same systems as financial data makes reporting more streamlined.

You have to work cross-functionally because all of that sustainability data is nested and housed within various departments across the organization. You want to set up clear accountability for data collection and reporting. There are a ton of ESG reporting tools out there now that can help make the process more efficient.

What are the biggest challenges organizations face when integrating impact metrics into their financial reporting?

The first challenge is determining which specific metrics to measure and report. SASB and ISSB are very helpful here. Any given business likely intersects five or six different SASB standards, and each SASB standard has around 10 unique KPIs. To determine what to report on, you need to narrow down to the top five to 10 most material KPIs that align with your double materiality assessment, looking at both financial and ESG impact.

The first year of impact reporting is the hardest because it’s a scavenger hunt to figure out where everything is, but it’s worth the effort to establish formal data collection and reporting structures across the organization that feed into the finance function. Encourage and empower departments to collect and report data into the finance and sustainability functions. The juice is worth the squeeze because now you know where all that data is going forward.

How do you see impact reporting evolving in the next five years?

I asked Scott Anderson, Audit Partner, to answer this one because he has been working in this space for years and is an expert in how it’s evolving. This is what he said:

“The investment banking community has much to gain in this softer market for transactions by encouraging their portfolio companies that are either seeking capital or exits to engage on metrics tracking related to ESG topics. Private company measurement and reporting on ESG metrics can help them demonstrate organizational value at higher multiples by highlighting relative performance to public companies on ESG metrics. Further, publicly traded companies that measure and report on ESG metrics typically achieve higher price-to-earnings valuations relative to peer sets. This evolving reporting paradigm supports the growing belief that non-financial metric and risk reporting will likely become integral to financial reporting and determining valuations over the next decade.”